Stay updated on SiSo product news

AI-Powered Solutions

For the Transaction Risk Insurance Industry.

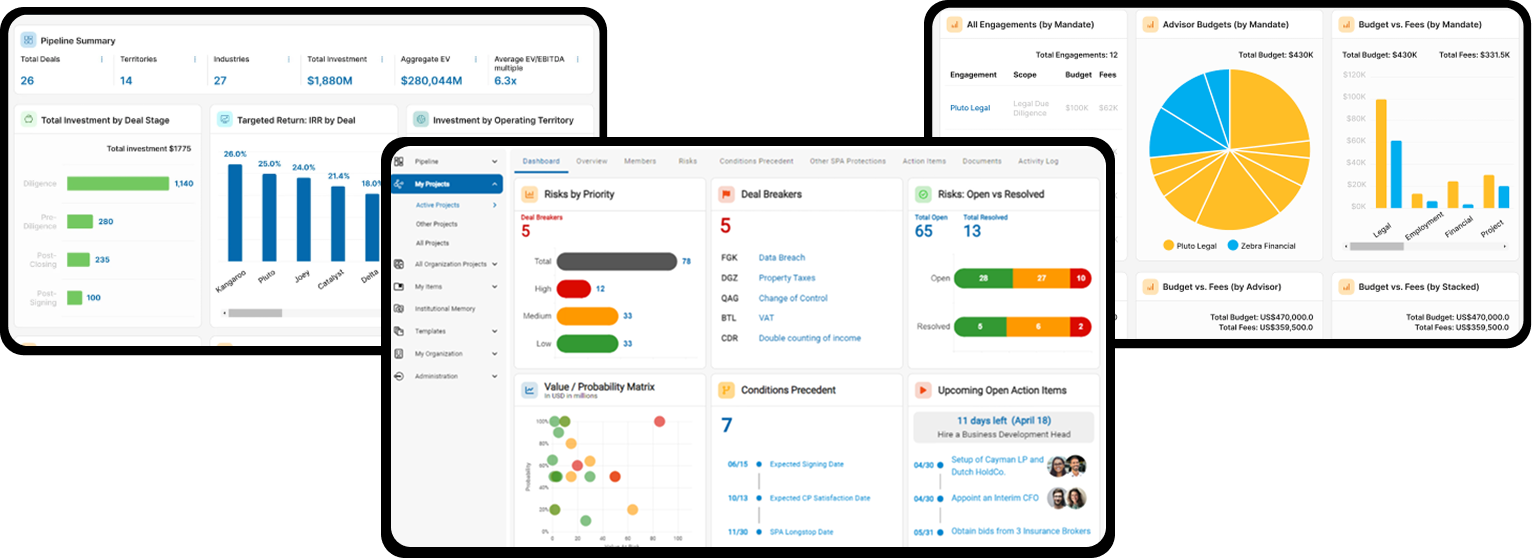

Used by Investors and Advisors. Now also by the Insurance Industry.

Book a demo

AI-Powered Use Cases for Transaction Risk Insurance

Our AI-powered applications have been designed in conjunction with transaction risk insurance professionals. And they integrate seamlessly into your typical transaction workflows. Our key areas include:

Submission Automation

Our AI-powered Submission Agent automates the generation of broker submissions to underwriters, fully integrated into purpose-built workflows designed to produce the outputs underwriters need. In a fraction of the time.

NBI and Proposal Generation

Our AI-powered NBI Agent uses cutting-edge AI to synthesize underwriters’ NBIs to generate proposals in a broker’s-style. Taking hours out of the manual preparation process.

Coverage Gap Analysis

Our Diligence Gap Analysis Agent uses AI to identify and visualize potential gaps between the scope of the due diligence scope of work and the insurance coverage sought. Enabling proactive gap identification that can be used to extend the due diligence or to scope the coverage accordingly.

Institutional Memory

Our AI-powered knowledge management solution enables brokers and underwriters to manage and extract insights and patterns from historic deals, providing a key reference point for future transactions.

Insurance Due Diligence

Harness the power of our cutting-edge AI to automate the review and reporting process for insurance due diligence. Materially reducing the amount of manual effort, without eliminating the human-in-the-loop to ensure quality control and verification.